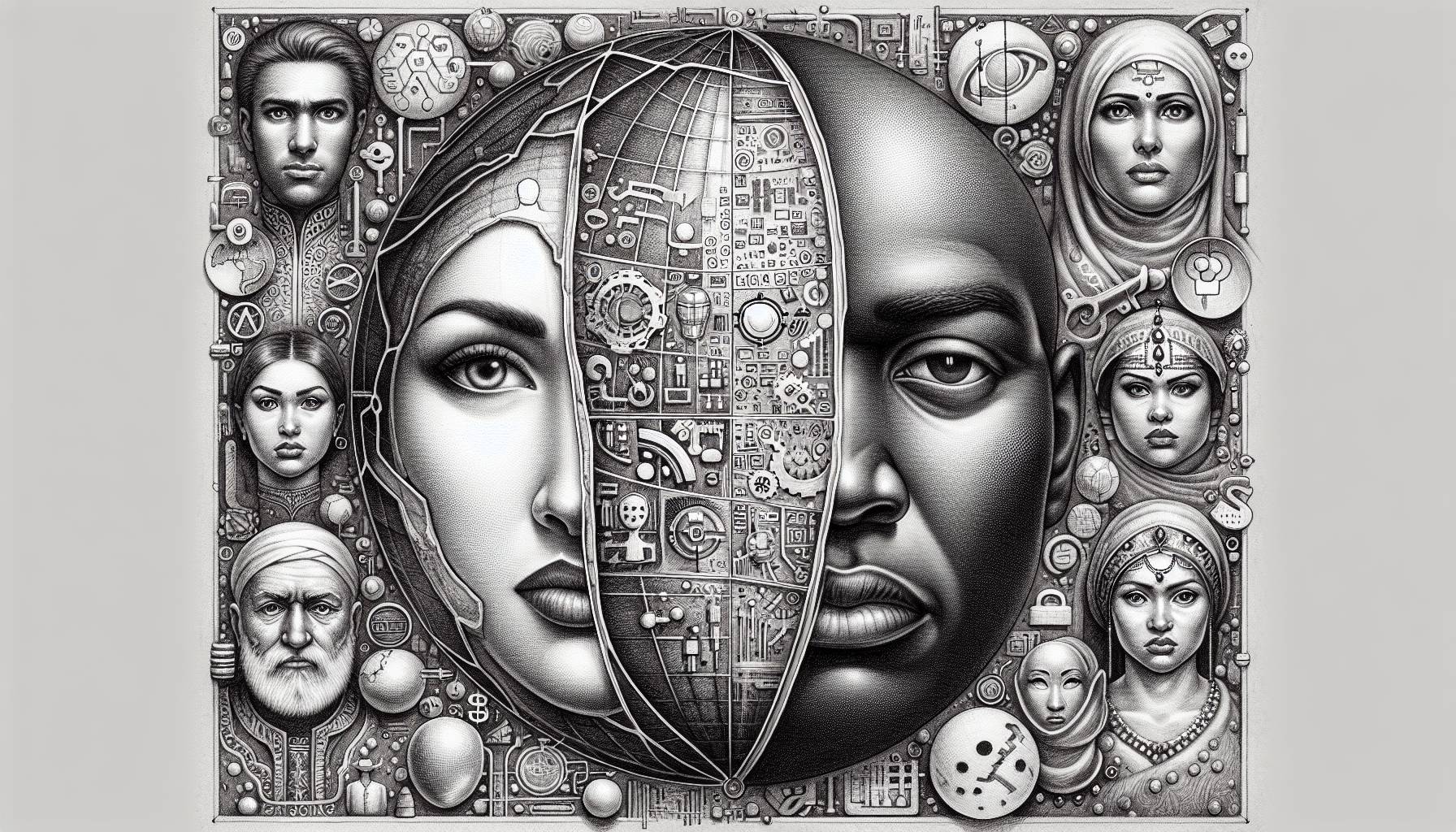

LinkedIn’s recently announced initial public offering, which has valued the company at nearly 17 times its revenue from last year, has spurred interest and skepticism in future public offerings by social media powerhouses such as Facebook, Twitter, Groupon and Zynga.

While LinkedIn’s rising price has stoked the IPO market across the board, it has also raised concerns that investor appetite for social media firms could soon wane. “My suspicion is that valuations like the kind we’re seeing with LinkedIn will eventually even out over the course of the year as more social media firms file to go public,” Hoovers editor Lee Simmons said. “That said, social media isn’t going away anytime soon, and as long as investors continue to exhibit this kind of pent-up demand for tech stocks, the industry will enjoy solid public market debuts.”

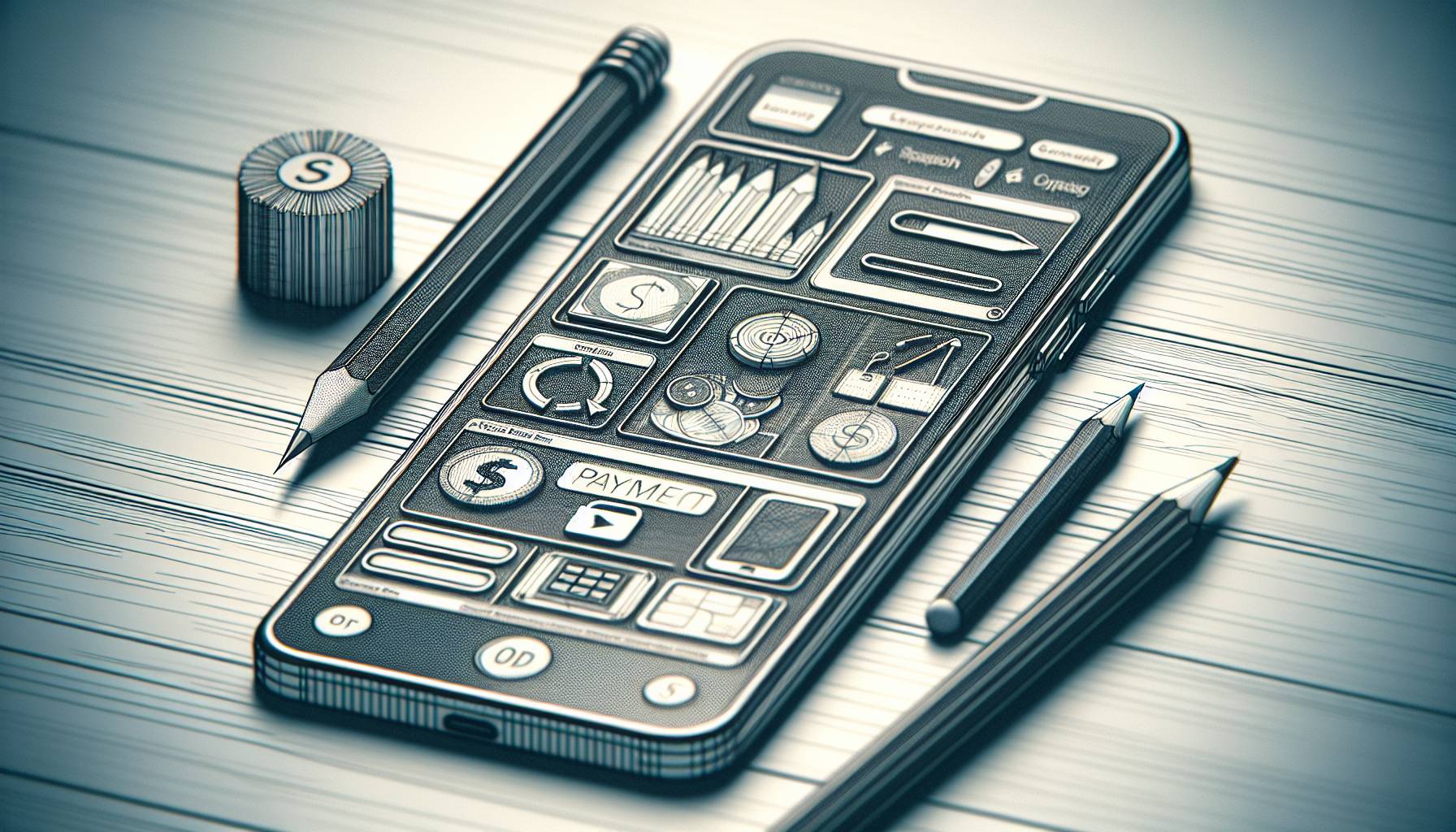

As these social media firms have already thoroughly saturated the traditional web-based market, mobile applications and advertising are likely to prove key to the success of their future growth plans as these firms attempt to go public.

Although Facebook has remained at the forefront of the mobile movement for years, with 150 million active mobile users as of last year, the company will need to capitalize on any potential mobile-based revenue opportunities to attract the attention of investors. Social media peer Twitter must continue its efforts to collaborate with third-party developers to growth its already mobile-heavy presence.

Meanwhile, Groupon has put mobile-based money making just one tap of the smartphone away with its easy-to-use mobile apps – and paved the way for more location-based revenue streams with its acquisition of Pelago. Similarly, online game operator Zynga has found a way to monetize the use of its games such as Mafia Wars and FarmVille for frequent users over both mobile and regular online platforms.

Although all of these social media players have proven they are a force in the mobile app industry, they must also prove that there are dollars behind these powers in order to attract greater interest and therefore more money for ongoing and future IPOs.